I posted a 2025 Stock Market Preview Video on January 1 for my Educational Members. It’s over 31 minutes long and here is the link to the first 10 minutes of that video. Here is a summary of some of the main points.

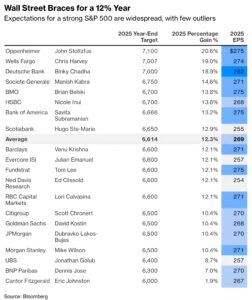

1) At the beginning of each year, Wall Street Strategists from the top 20 firms give their S&P 500 target for the upcoming year. They are usually conservative with their targets and predict about a 6-10% gain because that’s around the average gain historically, and you can’t get fired for making a conservative prediction. Coming into 2023, for the first time in over 30 years, the consensus estimate was for a NEGATIVE year. Clearly, these strategists were affected by the recency bias of the bear market in 2022. The result: They were dead wrong, as the S&P 500 was up over +25%.

Coming into 2024, the average target was 4800. They were basically expecting a flat year because the index closed at 4770. The result: WRONG AGAIN, as the S&P 500 was up over +23%.

Coming into 2025, the consensus is for a +12% year (see table below). I don’t see this happening. My feeling is they got burned the past two years, and they are overcompensating for their prior bearishness. Once again, they are being affected by recency bias.

2) I don’t see a double-digit gain for the S&P 500 in 2025. I can see a positive year in the single digits, but it won’t be an easy year. That’s why this post is titled: “Keep Your Expectations Realistic.” After two 20+% years for the S&P 500, some digestion or consolidation should be expected. Some people might say this is a negative or bearish view, but it is absolutely not! I still love some individual stocks that I feel have considerable upside in 2025, and I still think there will be an incredible rally, but my instincts tell me that it will be later this year and from a lower level.

3) I am expecting a 10-15% correction at some point this year for the S&P 500. I just have no clue if it will happen early in the year or later this summer. This is not exactly a bold call because the average intra-year correction over the past 50 years is approximately 14.5%.

4) There’s way too much bullish sentiment coming into 2025, and my feeling is the market needs to shake some of this out. For example, according to The Conference Board, this is the highest level (in the history of their survey) of people expecting stock prices to rise in the upcoming year. In addition, there are incredibly high levels of leveraged bullish ETF ownership, and speculative call buying is also high based on the historical data. Keep in mind the market tends to fool the majority.

5) One of my favorite Stanley Druckenmiller quotes is: “Probably one of my greatest assets over the last 30 years is that I’m open-minded and I can change my mind very quickly.” I refer to this quote because I have no problem changing my mind if needed. Some might say this is a cop-out hedge, but I view it as being flexible and being able to adapt if the facts change. For example, I realize that after two 20+% years in 1995 and 1996, the market continued with THREE more amazing years. This was due to an invention (the internet) that revolutionized our lives and increased productivity. The analogy is that if the new current invention (artificial intelligence) helped to boost earnings, then I could see a very strong year. I would also need to see an accommodative Fed, but I don’t expect that anytime soon. BOTTOM LINE: Be open-minded and keep your stock market expectations realistic for 2025. Good luck this year!

I can be reached at: jfahmy@zorcapital.com.

Disclaimer: This information is issued solely for informational and educational purposes and does not constitute an offer to sell or a solicitation of an offer to buy securities. None of the information contained on this blog constitutes a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. From time to time, the content creator or its affiliates may hold positions or other interests in securities mentioned on this blog. The stocks presented are not to be considered a recommendation to buy any stock. This material does not take into account your particular investment objectives. Investors should consult their own financial or investment adviser before trading or acting upon any information provided. Past performance is not indicative of future results.