A stock idea that could have decent potential over the next 6-12 months is recent software IPO Fastly, Inc. (Symbol: FSLY). The company is involved in “Edge Computing,” which allows data to be processed closer to where it is created (along the edge of the network) instead of sending it across longer routes to data centers or clouds. Basically, they specialize in delivering dynamic and personalized content at ultra-fast speeds. If you would like to read more about edge computing, click here for a great Bloomberg article about it.

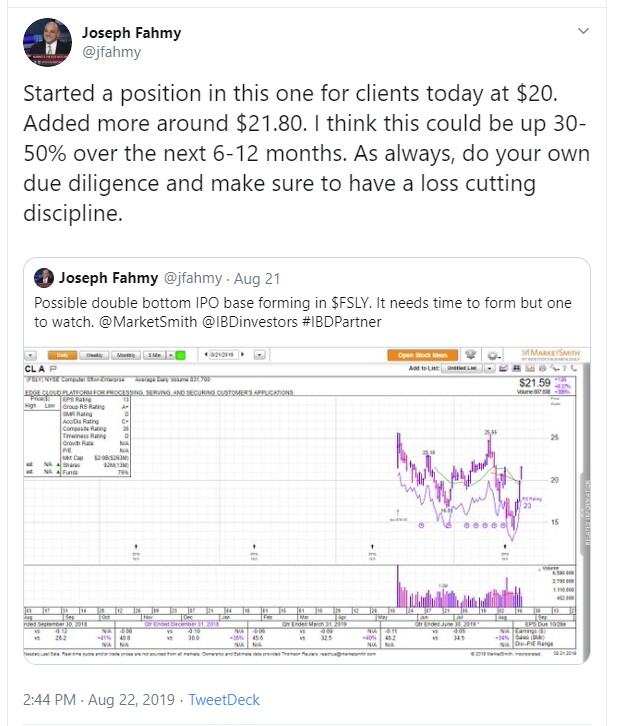

Technicals – The company recently went public in May of 2019. I like how it started to form an IPO base then saw a nice shakeout before institutional buyers came in and bid the stock up from around $20 to $35. For the first two weeks of September, while most software companies have experienced deeper corrections, FSLY has pulled back on light volume and continues to show great relative strength.

Fundamentals – The company has steadily grown revenues around 30-40% the past 8 quarters. According to a recent BAML research note: “We model +30% annual revenue growth for the next three years and expect gross margins to grow from 57% in 2018 to 63% in 2021, with add-on solutions able to provide upside to our model. Fastly operates 1,600 servers in 60 Points of Presence globally, using expensive $30,000 servers, low-latency Arista switches, and solid-state drives. In addition, Fastly uses Varnish open source software for caching, which enables it to globally update content in < 1 minute vs. competitor specs of 15-30 minutes.” They go on to say “Fastly is a developer-friendly company, as its specialized edge cloud enables high levels of programmability and analytics, unmatched by competitors.”

High Short Interest – As of 8/30/19, the company’s short interest is approximately 51% of the float. This high short interest is mainly due to the high competitive nature of the edge computing and content delivery network (CDN) markets. Some of the basic capabilities that Fastly provides could become commoditized and experience pricing pressure. They are not expected to turn a profit until 2021 and some short sellers I spoke to say the increased competition could push this out further and they could see pressure on margins. Again, I simply like to present both sides. If the short thesis does not work out, it could provide for more fuel to the upside.

Full Disclosure – I currently hold a position in this stock for clients. I tweeted about it on 8/22/19 and continue to hold my position.

The purpose of this blog post is idea generation and to show you how I combine both technicals and fundamentals to help increase my probabilities of a trade working out. It is impossible to guide people how to trade any idea because everyone has different time frames. If the market cooperates, I feel this is a stock that can appreciate 30-50% over the next 6-12 months. The stock closed Wednesday (9/18/19) at $28.61 and should have strong support in the $24-25 range. Good luck!

I can be reached at: jfahmy@zorcapital.com.

Disclaimer: This information is issued solely for informational and educational purposes and does not constitute an offer to sell or a solicitation of an offer to buy securities. None of the information contained on this blog constitutes a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. From time to time, the content creator or its affiliates may hold positions or other interests in securities mentioned on this blog. The stocks presented are not to be considered a recommendation to buy any stock. This material does not take into account your particular investment objectives. Investors should consult their own financial or investment adviser before trading or acting upon any information provided. Past performance is not indicative of future results.