MOST RECENT POSTS

Educational Webinar Recording 11/28/25

I’m running a special for my Educational Product until Sunday, November 30, 2025. Use the discount code: take100off and you will not only get $100 off your first quarter subscription, but my web team will also ADD one month FREE to your membership! This will give you access until March 31, 2026. I’ve received great feedback from members and I’m confident that you will build your confidence as a trader. Here is the link to sign up: https://joefahmy.com/investor-education

In my Educational Product, I produce videos twice a week with market analysis and stock ideas. I also conduct regular Stock Screening Webinars. Here is the FREE Educational Webinar I recorded on Friday, November 28, 2025.

I can be reached at: jfahmy@zorcapital.com.

Disclaimer: This information is issued solely for informational and educational purposes and does not constitute an offer to sell or a solicitation of an offer to buy securities. None of the information contained on this blog constitutes a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. From time to time, the content creator or its affiliates may hold positions or other interests in securities mentioned on this blog. The stocks presented are not to be considered a recommendation to buy any stock. This material does not take into account your particular investment objectives. Investors should consult their own financial or investment adviser before trading or acting upon any information provided. Past performance is not indicative of future results.

Staying Focused Through Volatility: The Long-Term Case for this Bull Market

A. The three main points I would like to emphasize:

1) The stock market still has significant upside. After nearly 30 years on Wall Street, one thing I’ve learned is that moves in the market last much longer than people expect. Just when investors think something can’t go higher, its usually does, and the same applies to the downside during bear markets. I believe people are underestimating how much upside remains over the next 2-3 years.

2) This is a broad and healthy Bull Market. This isn’t just about AI. There are multiple growth themes driving leadership such as: data centers, space, drones, robotics, alternative energy, biotech, and China. This broad-based participation is the hallmark of a healthy and sustainable bull market.

3) Of course, there will be pullbacks, shakeouts, and corrections along the way, but this is NOT 1999. If anything, there’s a bubble in people calling for bubbles.

B. In early June, I sent a Market Note to Members talking about the bigger picture. I then posted it on my blog in a piece titled: Don’t Lose Sight of the Bigger Picture. Here are a few themes I discussed in that post:

1) A new bull market began in May 2023, powered by Artificial Intelligence. Some trace it back to the October 2022 lows, but May 2023 marked the inflection point when Nvidia (the true AI market leader) released one of the greatest earnings reports in history, confirming the start of a powerful new cycle.

2) Throughout history, bull markets have been fueled by inventions and innovations that revolutionize our lives. Examples include railroads, television, airlines, drug discoveries, personal computers, smart phones, and the internet. What do all these have in common? They help to increase productivity. AI is the next major wave, and it’s already driving productivity gains across many industries. This is the fundamental reason I believe we’re in a longer-term uptrend.

3) I’ve frequently compared this cycle to the internet boom of 1995-2000. If this current market is going to have a similar path (meaning both markets being powered by major inventions), then this bull market could last for approximately 2-3 more years. I included the updated chart comparing the Nasdaq Composite from the late 1990’s to the current market, and it overlays Netscape web browser releases to ChatGPT releases.

C. Here is my reasoning for more upside:

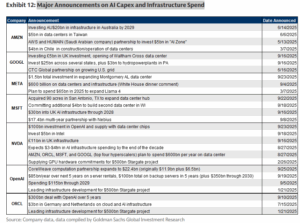

1) We continue to see major AI infrastructure deals and CapEx announcements.

– Microsoft: $17.4B deal with NBIS for GPU capacity.

– Oracle: AI Cloud infrastructure expected to grow 8x in five years; $300B data center deal with Open AI.

– CoreWeave: $14.2B deal with Meta and $6.5B expansion with OpenAI, bringing total contracts to approximately $22.4B; they also continue to be a key partner with NVDA.

– OpenAI and AMD: long-term deal to deploy 6GW of GPUs for AI training and inference starting in 2026.

As Jensen Huang said: “We’re a couple of hundred billion into a multi-trillion infrastructure buildout.” In other words, we’re not even 10% through this transformation. These are productive investments by mega-cap leaders, creating real revenue opportunities for smaller companies across the ecosystem.

2) The Fed. As Marty Zweig famously said: “Don’t fight the Fed.” The Fed is cutting rates. This added liquidity continues to provide an equity-friendly environment.

3) Technical Strength. The technicals are important because the big institutions control the market and we have to do our best to interpret what they are doing.

– The 10-week moving average is an area of institutional support. This level has held firm since the Zweig Breadth Thrust in late April 2025, confirming institutional buying support in both the Nasdaq Composite and S&P 500.

– There’s been very little distribution (big down days on heavy volume). Each time the market has dipped (for example the first trading days of August and September), institutions have stepped in to buy.

– Growth stocks just completed a healthy 6-8 week consolidation (from mid-July to early September). I highlighted it on the chart of the ARKK ETF (a basket of high beta growth stocks). I view this consolidation as healthy price action after the strong move off the April lows.

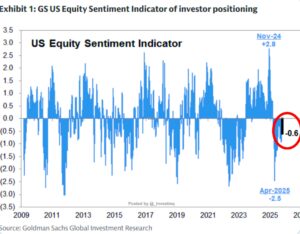

4) Sentiment is still muted, not euphoric.

– Goldman Sachs US Equity Sentiment Indicator: Below average.

– Deutsche Bank Positioning: Above average but not extreme.

– CNN Fear & Greed Index: Fearful (29).

– NAAIM Exposure Index: 84, below last quarter’s average.

Bottom line: Skepticism still dominates. Every uptick is met with disbelief, and “bubble talk” remains rampant. In my experience, real bubbles aren’t called out this loudly while they are happening. Keep in mind that Alan Greenspan warned of “irrational exuberance” in December 1996 when the Dow Jones was around 6400. It pretty much doubled over the next 3 years.

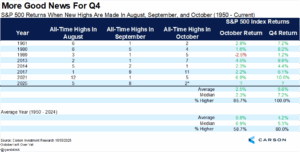

5) Seasonality – Strong Historical Tailwinds

– The fourth quarter is traditionally strong.

– Since 1950, whenever the S&P 500 has hit new highs in August, September, and October, the fourth quarter has never finished negative.

6) The institutional options positioning remains strongly supportive of higher equity prices.

– Mega Caps: Massive long call positions in NVDA, TSLA, TSM, COIN, DASH, AMZN, and GOOGL initiated near the April 2025 lows are being rolled forward monthly, maintaining a bullish bias.

– Industrials: Similar bullish structures in GE, JCI, ETN, GEV, PH, PWR, and URI, suggesting large funds expect continued earnings momentum.

– Put Sales: Large put selling at higher deltas showing willing institutional buyers even on shallow pullbacks, aligning with the view that many were underexposed to the Q3 rally and are now buyers on dips.

– Long-Term Outlook: January 2028 options just opened with light participation, but flows remain decisively bullish through June 2026.

– Thematic Groups: Nuclear, AI, Drones, Space, and Rare Earth plays are seeing heavy call activity.

This activity paints a clear picture: Institutions are preparing for more upside.

7) Conclusion

– All these factors suggest that we’re still in a multi-year growth phase. Elon Musk has referred to this period as an opportunity to create “generational wealth,” and Jensen Huang has said “AI will create more millionaires in 5 years than the internet did in 20.”

– The key is to stay focused on the strongest growth stocks, stay focused on the bigger picture, but also take profits along the way. If you never take profits, you will ride it all the way up and then all the way down as many did during the internet boom/bust.

– Again, there will be many pullbacks and corrections along the way. Calmness, focus, and discipline will be very important until the fundamentals change. Right now, some of them are just getting started.

I can be reached at: jfahmy@zorcapital.com.

Disclaimer: This information is issued solely for informational and educational purposes and does not constitute an offer to sell or a solicitation of an offer to buy securities. None of the information contained on this blog constitutes a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. From time to time, the content creator or its affiliates may hold positions or other interests in securities mentioned on this blog. The stocks presented are not to be considered a recommendation to buy any stock. This material does not take into account your particular investment objectives. Investors should consult their own financial or investment adviser before trading or acting upon any information provided. Past performance is not indicative of future results.

MORE POSTS

FEATURED ON FOX BUSINESS:

Wall Street’s bull market continues…but for how long?

Receive More Information About Our Services:

SOCIAL LINKS